Summary

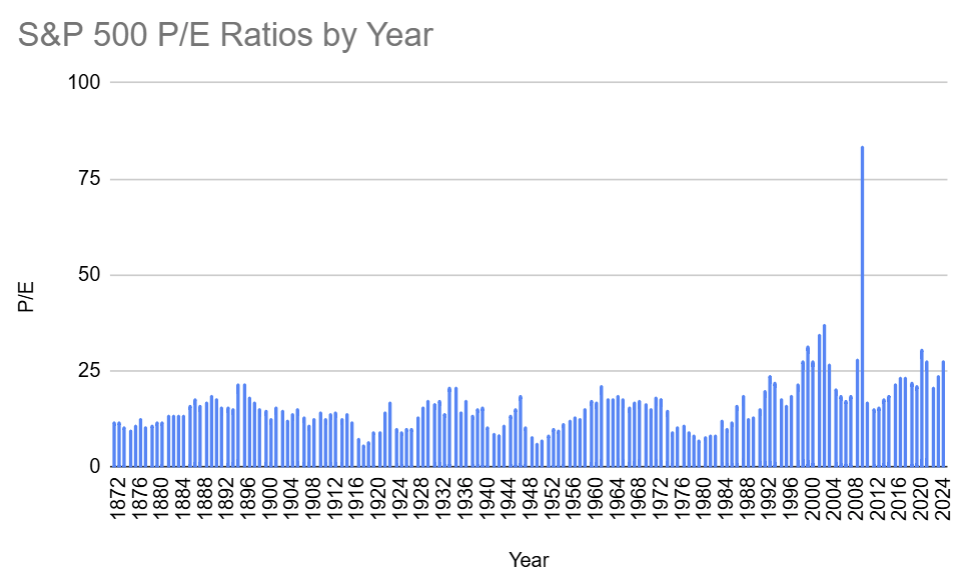

The table below includes price-to-earnings (P/E) ratios for the S&P 500 since 1871.

A single value is provided for each year—the mean of the trailing 12 month P/E throughout that year.

The P/E is the ratio of market cap to earnings. If Apple had a market cap of 2 trillion

USD and earned 100 billion USD last year, it's P/E would be 20 (2/.1).

This is equivalent to the share price divided by the earnings per share (EPS).

S&P 500 P/E ratios have historically had an inverse correlation to future annual returns:

a two point increase in P/E results in a 1%+ loss of annual return (on average).

For example, a "normal" P/E of 17 is associated with an 11.4% year-after annual return, while a

"high" P/E of 27 produces an expected annual return of just 5.7% (on average).

Notable values for these P/E ratios follow.

Historical mean (since 1871): 16.11

Historical median (since 1871): 15.28

Historical min/max: 6.08/83.60

Last 25 years mean: 25.72

Last 10 years mean: 24.44

Last 5 years mean: 26.29

Table of mean annual P/E ratios of the S&P 500

| Year | P/E |

|---|

| 2024 | 27.85 |

| 2023 | 23.75 |

| 2022 | 21.02 |

| 2021 | 27.92 |

| 2020 | 30.92 |

| 2019 | 21.58 |

| 2018 | 22.33 |

| 2017 | 23.53 |

| 2016 | 23.61 |

| 2015 | 21.94 |

| 2014 | 18.76 |

| 2013 | 17.81 |

| 2012 | 15.79 |

| 2011 | 15.14 |

| 2010 | 17.13 |

| 2009 | 83.60 |

| 2008 | 28.39 |

| 2007 | 18.69 |

| 2006 | 17.29 |

| 2005 | 18.90 |

| 2004 | 20.50 |

| 2003 | 26.95 |

| 2002 | 37.28 |

| 2001 | 34.59 |

| 2000 | 27.72 |

| 1999 | 31.69 |

| 1998 | 28.01 |

| 1997 | 21.70 |

| 1996 | 18.88 |

| 1995 | 16.03 |

| 1994 | 18.09 |

| 1993 | 22.44 |

| 1992 | 24.05 |

| 1991 | 20.05 |

| 1990 | 15.47 |

| 1989 | 13.34 |

| 1988 | 12.65 |

| 1987 | 18.66 |

| 1986 | 16.13 |

| 1985 | 11.99 |

| 1984 | 10.08 |

| 1983 | 12.38 |

| 1982 | 8.60 |

| 1981 | 8.54 |

| 1980 | 7.97 |

| 1979 | 7.38 |

| 1978 | 8.43 |

| 1977 | 9.42 |

| 1976 | 11.14 |

| 1975 | 10.66 |

| 1974 | 9.52 |

| 1973 | 14.79 |

| 1972 | 18.13 |

| 1971 | 18.32 |

| 1970 | 15.25 |

| 1969 | 16.78 |

| 1968 | 17.70 |

| 1967 | 17.13 |

| 1966 | 15.71 |

| 1965 | 18.12 |

| 1964 | 18.76 |

| 1963 | 18.13 |

| 1962 | 18.04 |

| 1961 | 21.41 |

| 1960 | 16.89 |

| 1959 | 17.46 |

| 1958 | 15.50 |

| 1957 | 12.98 |

| 1956 | 13.12 |

| 1955 | 12.50 |

| 1954 | 11.31 |

| 1953 | 9.94 |

| 1952 | 10.30 |

| 1951 | 8.44 |

| 1950 | 7.16 |

| 1949 | 6.43 |

| 1948 | 8.14 |

| 1947 | 10.80 |

| 1946 | 18.84 |

| 1945 | 15.54 |

| 1944 | 13.54 |

| 1943 | 10.92 |

| 1942 | 8.62 |

| 1941 | 8.83 |

| 1940 | 10.78 |

| 1939 | 15.71 |

| 1938 | 15.31 |

| 1937 | 13.48 |

| 1936 | 17.50 |

| 1935 | 14.32 |

| 1934 | 21.14 |

| 1933 | 20.96 |

| 1932 | 13.96 |

| 1931 | 17.47 |

| 1930 | 16.70 |

| 1929 | 17.33 |

| 1928 | 15.86 |

| 1927 | 13.17 |

| 1926 | 10.11 |

| 1925 | 10.13 |

| 1924 | 9.50 |

| 1923 | 10.26 |

| 1922 | 17.26 |

| 1921 | 14.31 |

| 1920 | 9.28 |

| 1919 | 9.18 |

| 1918 | 6.77 |

| 1917 | 6.08 |

| 1916 | 7.84 |

| 1915 | 11.73 |

| 1914 | 13.94 |

| 1913 | 12.85 |

| 1912 | 14.70 |

| 1911 | 14.15 |

| 1910 | 12.57 |

| 1909 | 14.36 |

| 1908 | 12.67 |

| 1907 | 11.07 |

| 1906 | 13.40 |

| 1905 | 15.37 |

| 1904 | 13.90 |

| 1903 | 12.49 |

| 1902 | 14.81 |

| 1901 | 15.97 |

| 1900 | 12.81 |

| 1899 | 15.07 |

| 1898 | 15.23 |

| 1897 | 16.95 |

| 1896 | 18.57 |

| 1895 | 21.93 |

| 1894 | 21.72 |

| 1893 | 15.41 |

| 1892 | 15.59 |

| 1891 | 15.87 |

| 1890 | 17.88 |

| 1889 | 18.92 |

| 1888 | 17.18 |

| 1887 | 16.00 |

| 1886 | 17.76 |

| 1885 | 16.01 |

| 1884 | 13.51 |

| 1883 | 13.62 |

| 1882 | 13.58 |

| 1881 | 13.52 |

| 1880 | 11.89 |

| 1879 | 11.82 |

| 1878 | 11.08 |

| 1877 | 10.79 |

| 1876 | 12.81 |

| 1875 | 11.00 |

| 1874 | 9.94 |

| 1873 | 10.78 |

| 1872 | 12.09 |

| 1871 | 11.73 |

|

|

Click here for other historical returns.

|