|

You may hear a lot of investment predictions.

Banks, research groups, and influencers push predictions frequently.

You probably also hear that these predictions are worthless.

The intent here is to look at past data to see how predicted

S&P 500 annual returns have matched reality.

We use a few different datasets, explained herein.

The first dataset is one we’ve been collecting for the past few years.

It’s very limited, preventing statistically meaningful conclusions,

but included because it does differ from the larger subsequent dataset in the years of overlap.

(The differences are due to using different sources of predicted annual returns.)

Our small dataset

We started saving published, year-ahead predictions for various investments, including the S&P 500, in late 2021, for the calendar years 2022 and on.

These are predictions, often made in December, for the change in the S&P 500 index in the subsequent calendar year.

At the time of this writing, we only have three years of data with actual returns to compare against (larger datasets will follow).

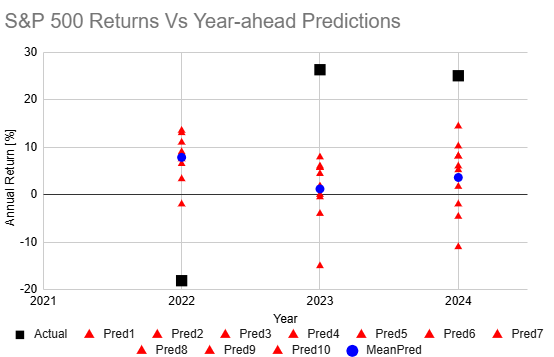

Below is a summary plot of this data.

The blue circles are the average (mean) of the predictions for that year,

the black squares are the actual returns, and each red triangle represents an individual prediction.

The predictions were pulled from reports by Goldman Sachs, Wells Fargo, US Bank, Oppenheimer, Credit Suisse, JP Morgan, ….

While limited, this data doesn’t bode well for predictions.

The highest actual return occurred in 2023, the year experts predicted the lowest return (blue dot).

Furthermore, the lowest actual return occurred in 2022, the year experts predicted the highest return.

So it’s not just that these predictions weren’t good, they were exactly opposite to what actually occurred.

Let’s look at a larger dataset from Nationwide.

Nationwide dataset

Nationwide, in their article

Be

skeptical of stock market predictions for the coming year,

includes a plot of predicted and actual S&P 500 returns since 2000.

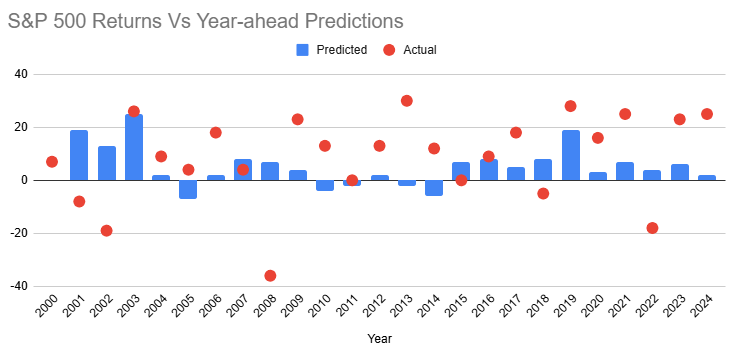

A summary of this data is plotted below.

This includes 25 years of predictions: 2000 to 2024, inclusive.

The predicted values are an average of year-ahead predictions as provided by

FactSet.

The mean error of the 25 predictions was over 15.3%.

This is the mean of the absolute values of the differences (actual minus predicted).

This is shockingly bad given that the mean return was just 8.6%.

Simply predicting a 0% return every year would’ve almost doubled the accuracy!

So the absolute accuracy is no good, but what about the variability.

Do years with higher predictions have higher actual returns and vice versa?

Not only is the answer no, it’s actually slightly the opposite:

On average lower predicted returns resulted in higher actual returns and vice versa!

The Pearson correlation coefficient between the actual and predicted returns is negative.

Longer-term predictions

While the results above were not surprising to me,

Morningstar’s

analysis of decade-ahead predictions was an exception.

In 2014, Morningstar collected predictions for the average annual return of the S&P 500 for the upcoming decade (2014-2024).

A decade average smooths over the less predictable (more chaotic) returns in each year.

After a decade, the market comes closer to matching the fundamental performance of the underlying businesses.

In 2014, I would’ve expected the experts (including Warren Buffett, Jack Bogle, and Jeremy Siegel), with their more conservative predictions, to be more accurate than the average layperson.

What did Morningstar find?

Those experts estimated average annual returns of 7.5%, while the average investor estimated 11%.

The actual result was 12.7%: the average man won.

In 2014, I would’ve bet on the experts in this case!

Of course, this was just one time period, so perhaps we shouldn’t put too much weight on this finding.

Check back soon as we'll be searching for more clues on longer-term predictions.

Login to leave a comment.

Related Articles

2025 Investment Outlook

Active versus passive investing

Should you try to beat the market?

Click here for a list of other recent articles.

|