Summary

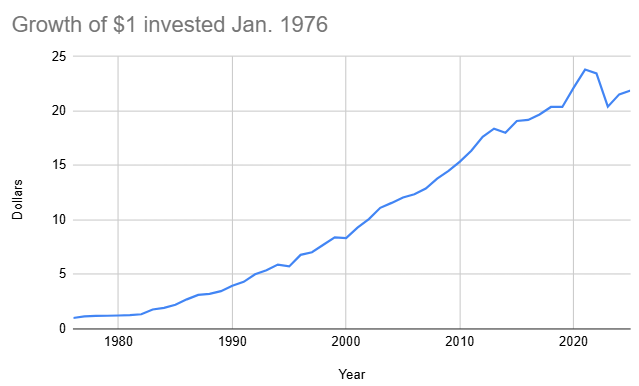

The Bloomberg US Aggregate Bond Index, formerly the Barclays Agg, is generally

considered the best US total bond market index.

It tracks bonds of investment-grade quality or better including government

Treasuries (about 40%), corporate bonds, mortgage-backed securities,

asset-backed securities, and munis.

Mean annual return (1976-present): 6.7%

Min/max annual return (1976-present): -13.0%/32.6%

Last 25 years mean annual return: 4.1%

Last 10 years mean annual return: 1.6%

Last 5 years mean annual return: 0.0%

Table of total yearly returns of the Blomberg US aggregate bond index

| Year | Return [%] |

|---|

| 2024 | 1.7 |

| 2023 | 5.5 |

| 2022 | -13.0 |

| 2021 | -1.5 |

| 2020 | 7.5 |

| 2019 | 8.7 |

| 2018 | 0.0 |

| 2017 | 3.5 |

| 2016 | 2.6 |

| 2015 | 0.5 |

| 2014 | 6.0 |

| 2013 | -2.0 |

| 2012 | 4.2 |

| 2011 | 7.8 |

| 2010 | 6.5 |

| 2009 | 5.9 |

| 2008 | 5.2 |

| 2007 | 7.0 |

| 2006 | 4.3 |

| 2005 | 2.4 |

| 2004 | 4.3 |

| 2003 | 4.1 |

| 2002 | 10.3 |

| 2001 | 8.4 |

| 2000 | 11.6 |

| 1999 | -0.8 |

| 1998 | 8.7 |

| 1997 | 9.7 |

| 1996 | 3.6 |

| 1995 | 18.5 |

| 1994 | -2.9 |

| 1993 | 9.8 |

| 1992 | 7.4 |

| 1991 | 16.0 |

| 1990 | 8.9 |

| 1989 | 14.5 |

| 1988 | 7.9 |

| 1987 | 2.7 |

| 1986 | 15.3 |

| 1985 | 22.1 |

| 1984 | 15.1 |

| 1983 | 8.4 |

| 1982 | 32.6 |

| 1981 | 6.2 |

| 1980 | 2.7 |

| 1979 | 1.9 |

| 1978 | 1.4 |

| 1977 | 3.0 |

| 1976 | 15.6 |

|

--> -->

|

Click here for other historical returns.

|