Summary

Real estate is one of the three primary investments, alongside stocks and bonds.

Real estate earns returns via property appreciation, rent, or royalties.

Royalties include extracting minerals, oil or lumber from a property.

People purchase investment properties by themselves or in groups.

Investment properties may include single family homes, duplexes, or apartments to name a few.

An alternative is to hold smaller pieces of more properties by buying shares of real estate investment trusts, or REITs.

REITs own and earn money from various properties, including apartments, offices, warehouses, data centers, hotels, and more.

REITs pay 90 to 100% of their taxable income as dividends to shareholders.

They offer a more diversified, hands-off option for real estate investing.

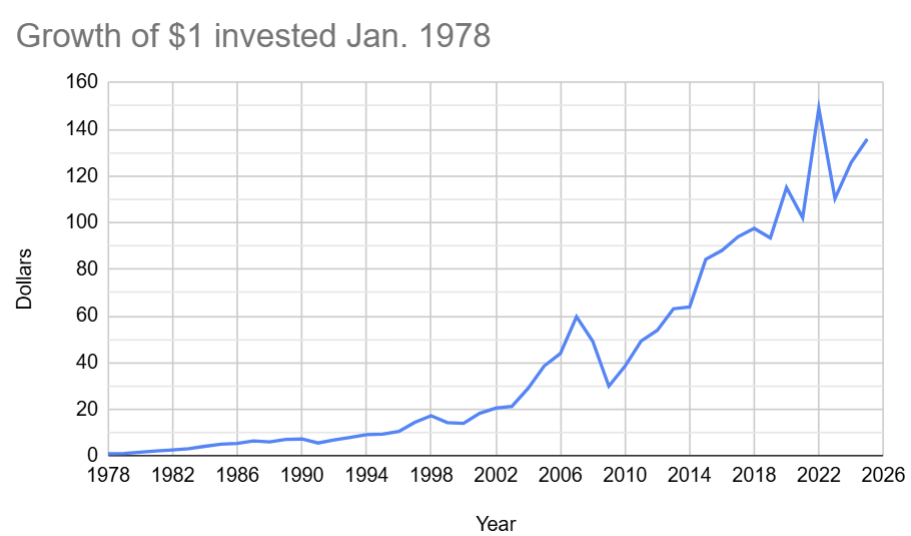

Real estate has historically provided returns comparable to stocks, as evidenced by the data below.

This data is based on the Dow Jones Select Real Estate Securities Index, which measures equity

REITs and REOCs traded in the US.

Historical mean annual return, 1978-present: 12.7%

Min / max annual return, 1978-present: -39.2% / 49.0%

Last 25 years mean annual return: 11.6%

Last 10 years mean annual return: 6.5%

Last 5 years mean annual return: 6.2%

Table of total annual returns of real estate

| Year | Return [%] |

|---|

| 2024 | 8.0 |

| 2023 | 14.0 |

| 2022 | -26.0 |

| 2021 | 45.9 |

| 2020 | -11.2 |

| 2019 | 23.1 |

| 2018 | -4.2 |

| 2017 | 3.8 |

| 2016 | 6.7 |

| 2015 | 4.5 |

| 2014 | 32.0 |

| 2013 | 1.2 |

| 2012 | 17.1 |

| 2011 | 9.4 |

| 2010 | 28.1 |

| 2009 | 28.5 |

| 2008 | -39.2 |

| 2007 | -17.6 |

| 2006 | 36.0 |

| 2005 | 13.8 |

| 2004 | 33.2 |

| 2003 | 36.2 |

| 2002 | 3.6 |

| 2001 | 12.3 |

| 2000 | 31.0 |

| 1999 | -2.6 |

| 1998 | -17.0 |

| 1997 | 19.7 |

| 1996 | 37.1 |

| 1995 | 12.2 |

| 1994 | 2.7 |

| 1993 | 15.1 |

| 1992 | 15.1 |

| 1991 | 23.8 |

| 1990 | -23.4 |

| 1989 | 2.7 |

| 1988 | 17.5 |

| 1987 | -6.6 |

| 1986 | 19.7 |

| 1985 | 6.5 |

| 1984 | 21.9 |

| 1983 | 32.2 |

| 1982 | 20.9 |

| 1981 | 17.9 |

| 1980 | 33.1 |

| 1979 | 49.0 |

| 1978 | 11.0 |

|

|

Click here for other historical returns.

|