Summary

The Nasdaq-100 includes the 100 largest non-financial companies on the Nasdaq exchange.

The Nasdaq-100 index measures the cap-weighted returns of these stocks.

Investors can buy this index with ETFs like QQQ.

This index is often used to measure the performance of the tech market because

it has a high concentration in large tech companies such as Apple, Amazon and Google.

For more information about the NASDAQ read

"Nasdaq: A History of the Market That Changed the World."

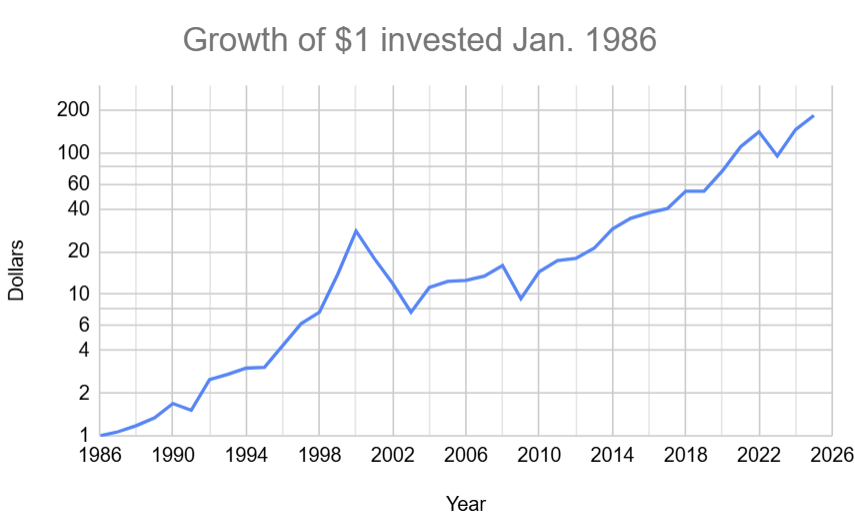

Notable values for this index follow. Dividend reinvestment is assumed in

all values.

Entire history mean annual return: 18.7%

Entire history min/max annual return: -41.7/101.9%

Last 25 years mean annual return: 12.1%

Last 10 years mean annual return: 21.1%

Last 5 years mean annual return: 24.6%

Table of total annual returns of the Nasdaq-100 (includes dividends)

| Year | Return [%] |

|---|

| 2024 | 25.88 |

| 2023 | 53.81 |

| 2022 | -32.54 |

| 2021 | 27.42 |

| 2020 | 48.4 |

| 2019 | 38.96 |

| 2018 | -0.12 |

| 2017 | 32.66 |

| 2016 | 7.1 |

| 2015 | 9.45 |

| 2014 | 19.18 |

| 2013 | 36.63 |

| 2012 | 18.12 |

| 2011 | 3.47 |

| 2010 | 20.14 |

| 2009 | 54.68 |

| 2008 | -41.73 |

| 2007 | 19.02 |

| 2006 | 7.14 |

| 2005 | 1.57 |

| 2004 | 10.54 |

| 2003 | 49.67 |

| 2002 | -37.37 |

| 2001 | -33.34 |

| 2000 | -36.11 |

| 1999 | 101.95 |

| 1998 | 85.3 |

| 1997 | 20.63 |

| 1996 | 42.54 |

| 1995 | 42.54 |

| 1994 | 1.5 |

| 1993 | 10.58 |

| 1992 | 8.86 |

| 1991 | 64.99 |

| 1990 | -10.41 |

| 1989 | 26.17 |

| 1988 | 13.54 |

| 1987 | 10.5 |

| 1986 | 6.89 |

|

|

Click here for other historical returns.

|