|

While day-to-day fluctuations in Bitcoin’s price may be unpredictable, longer term trends display patterns.

The clearest pattern has been the four year Bitcoin cycle.

In this article, we’ll discuss this pattern and implications.

The cycles

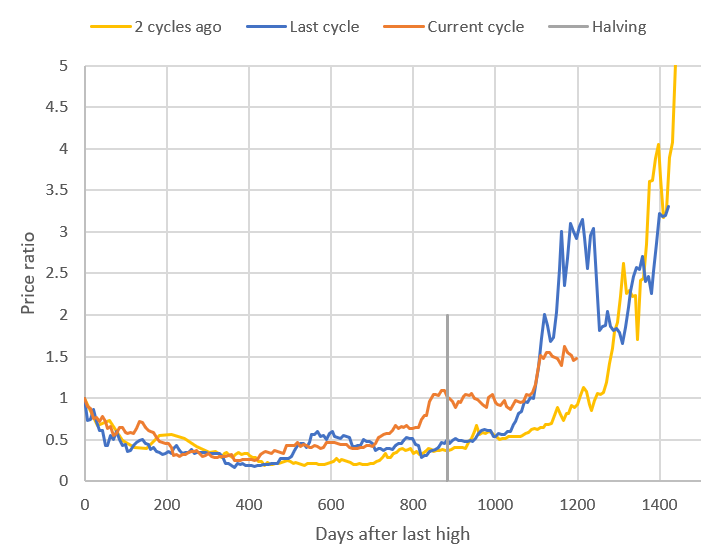

The plot below shows the current cycle “price ratio” alongside the prior two cycles.

The price ratio here is the price on the given day divided by the prior all time high (ATH).

The horizontal axis represents the days elapsed since the prior ATH.

This plot (not the article) was updated on February 18, 2025.

The plot shows that, about a year (370 days) after the ATH, the price ratio bottoms out around 0.2—an 80% price drop.

A couple years after that, the price reaches the ATH from the prior cycle.

After that, the price increases substantially to multiples of the prior ATH.

The current cycle differs in that we’ve already hit a new ATH, perhaps due to spot ETF approvals in the US.

Based on prior cycles, where is Bitcoin going?

As you can see from the plot, if this cycle behavior repeats, Bitcoin could surpass $150k in 2025.

We are about 2.5 years into this cycle, so we’d expect to reach a new ATH within about 1.5 years (4 years total).

All past cycles exceeded 3x the prior cycle high, which would be $180k for this cycle.

However, this multiple has decreased with each cycle, and hence it may be less than 3x for this cycle.

However, for the next 100 days, we wouldn’t expect a major price increase.

In prior cycles, these next 100 days, while volatile, have not resulted in substantial long-term ups or downs.

Are halvings the cause of these cycles?

Bitcoin “halvings” have occurred roughly every four years, like these cycles.

It’s unclear if this is a major cause of the cycles, but it likely contributes.

Some Bitcoin miners sell a portion of the coins they mine.

After a halving occurs, they earn fewer Bitcoins and hence have less to sell.

As with any market, less supply generally boosts price.

Indeed, in each cycle, the price begins its major ascent about 100 days after the halving.

Warning

These type of multi-year cycles have occurred with other assets, but they don’t last forever.

There were three and a half such cycles before the DOTCOM bubble burst in 2000.

So...these cycles repeat until they don’t!

We'd be remiss not to provide another warning. It's very possible that Bitcoin's price is manipulated.

There are numerous examples of this in Bitcoin's history.

Although it seems less so today, there are still suspicious trading patterns.

So-called whale's, who own a large supply of Bitcoin,

can execute large trades to move the price up/down and give the appearance of a pattern.

They do this to fuel their growth—luring in buyers at high prices and enticing them to sell at lower

prices.

My take

There's a good chance Bitcoin could surpass $100k in the next year or so.

That's more appreciation than I expect from other assets I’m watching.

However, I also believe it’s possible, though less likely, that the last high could be the all-time high.

As such, I had about 5% of my portfolio in Bitcoin late in 2023 and, given the dramatic price increase, it’s now much more than 5%.

I probably won’t let it get to 10%—if it nears 10% of my portfolio I will begin selling to keep my allocation well below 10%.

May 2, 2024 Update

Many people asked us to provide updates on where we stand in the Bitcoin cycle.

We therefore plan to add updates here periodically, and we'll update the plot at the top of the page.

The plot above includes the most recent data up to May 2, 2024.

(To understand price ratio and this plot, please see the article above.)

We are over 900 days into this cycle, slightly past the halving on April 19, 2024.

Although the price has declined recently, it remains well above the

expected price based on prior cycles.

If the price follows prior cycles, it will spend the next three months in the range

of the last few months (that's a pretty big range).

The second half of this year would be the time for a major price increase, again

if the price follows this historical pattern.

May 10, 2024

Updated chart below.

Bitcoin's price has remained in the expected range we discussed last week (the range of the last few months).

It's made small movements up recently, but the long-term cycle we are discussing isn't used to

foresee these smaller, short-term movements.

We are using it more for the major, long-term price movements.

May 18, 2024

Bitcoin is up about 8% since our May 10 update.

It remains within the expected range, but on the upper end of that range.

For the last 100 days the price has hovered near the ATH of the prior cycle.

If the pattern of prior cycles continues, a strong breakout above this price will

occur later this year.

May 25, 2024

Bitcoin briefly exceeded 71k USD this week, nearing the ATH.

It's since dropped back to 68.5k USD and remained in the expected range.

As time ticks by, risk increases for those on the sidelines wanting to buy

in before the potential big climb.

While it may not be imminent, the ascent could start at any time from next week until next February.

More eyes were on Ethereum this week as the US SEC approved Ethereum spot ETFs.

Those ETFs require further approvals before trading will begin.

Bitcoin spot ETFs were approved around day 790 in this cycle and, as you can see from the

chart, it took another 60 days or so for the price to climb substantially.

June 1, 2024

There was no significant news in the Bitcoin space last week.

Bitcoin continues to hover in the price range we anticipated and

appears to be at least a month away from a big run.

For those that are too confident in these cycles, please read the

warning section above.

There is no guarantee this cycle behavior will continue.

In fact, we can say it definitely will not at some point—if that behavior

continued another few cycles Bitcoin would be worth more than all the money and assets on Earth.

The only real question is when. Will it be this cycle or next cycle when the behavior changes?

June 15, 2024

Bitcoin remains in the expected range we've discussed ad nauseam.

There is one significant update in the last couple weeks (for me at least).

One of the risks we talk about with Bitcoin is political—the US and other

big governments have the potential to hurt Bitcoin by passing restrictive laws.

While it was a longshot already, it seems the probability of this

has shrunk recently.

Rumors indicate that politicians are becoming leary of anti-crypto talk or legislation, fearing it will

cost them votes.

Politicians that have spoken against crypto have recently changed course and in some

cases are pressuring the SEC in a pro-crypto fashion.

Despite this, the US SEC will likely continue cracking down on crypto in the near term.

They feel that a number of laws continue to be broken, primarily failure to

provide adequate disclosures to crypto investors.

These actions may penalize or even close crypto-related business in the short-term,

but the longer-term legal picture has become brighter to my eyes.

June 22, 2024

Bitcoin remains in the expected range.

No significant news this week in my opinion.

Ethereum, on the other hand, had positive news this week.

Spot ETFs are likely to begin trading before the July 4th holiday, and

they've disclosed potential investors like Pantera.

The SEC also dropped its Ethereum 2.0 investigation.

Some of the political things we discussed last week may have played a role in

these happenings.

July 4, 2024

Bitcoin has fallen and some investors have panicked.

If you're watching the price day-to-day or hour-to-hour it can feel horrific,

but the plot puts it in another perspective.

Recent drops, while significant, are a small blip

in the larger cycle behavior.

The price is still well above the same period in past cycles.

The abnormally high price achieved early this year was more significant and

potentially cycle-braking than the recent drop.

That, along with this long, slow retreat from that price may sow doubt.

As we've said, the cycle behavior won't last 2 more cycles.

The question is when, not if, this cycle behavior ceases.

While I feel it's still in play, it's very far from a certainty.

July 19, 2024

Bitcoin's price has increased significantly since our last post on July 4.

The fear so many expressed is receding.

In my view, nothing has changed since then.

We are still in trend as discussed before, but on the higher side.

The only difference now is that we are 2 weeks further along.

We are just a couple months from where the price explosion started in the last two cycles, and just about a month from the low before the ascent.

Let’s see what happens in the next few weeks!

August 3, 2024

Bitcoin price took a hit recently, stoking fear again.

If you look at the updated chart (top of the page), you may see why I think

this is small noise in the big picture.

We are still within the expected range, and even on the upper side of it.

I've been asked: "what would it take for you to give up on this cycle?"

This is a good question, you should determine such things before

purchasing an asset. You don't want to invent such criteria in an emotional state,

after investing and potentially losing money.

If this price ratio shown in the plot remains below 1.3 for another year (August 2025),

I'll lose faith in this cycle behavior.

Alternatively, if the ratio drops below 0.4 within the next year I'll give up on this.

August 11, 2024

In the last week Bitcoin dropped below 50k USD and then jumped above 60k USD.

Although volatility has decreased steadily in the last few years, it remains high

relative to gold, stocks, and other assets.

The price remains on the high side of the expected range, based on prior cycles.

Some prominent investors have predicted a "banana zone"—a period

of time where crypto prices increase sharply and FOMO creates many new crypto investors.

This would certainly fit with the 4 year cycle, but investors must be aware: there's no guarantee of such

behavior. Also be aware that, even if this "banana zone" comes, it could be preceded by more volatility

including 50% price drops.

Many investors may succumb to this volatility and sell/lose money even if the banana zone comes.

August 25, 2024

We don't normally speak of interest rates here. For the past year,

many investors have predicted eminent interest rate reductions that

never came to fruition. However, it seems the time is near.

The Fed chairman telegraphed this in a meeting last week.

Interest rate reductions generally lift asset prices in the short-term, but one could argue this

is already baked into current prices.

There are a number of claims as to how interest rates may impact Bitcoin price.

It's hard to imagine lower interest rates reducing the USD value of a Bitcoin, but it's also

hard to see how this, alone, would lead to a substantial increase.

One exception may be the psychological impact—many will claim rate reduction

is the key to unlock a bull run.

This will induce some buying pressure, but hard to say if it will be small/negligible

or lead to a sizable gain.

September 9, 2024

We are well over 100 days past the ATH and Bitcoin is not finding a spark.

Perhaps more unnerving is the fact that the price ratio (see the plot at the top of this page)

may intersect the prior cycle soon, after being well above it for months.

Nonetheless, we are still in the expected range we’ve discussed ad nauseam.

The rough cycle behavior is not invalidated yet and implies a substantial price increase within the next 250 days.

Again, remember the cycle behavior will break down at some point.

While I don’t think it’s happened yet, it could occur in this cycle.

Don’t assume the 200+% return in the next 250 days will happen, only that it has a realistic chance!

September 23, 2024

The Fed reduced interest rates 0.5 percent, more than the quarter percent many expected.

This propped up many asset prices, including Bitcoin.

The 9% increase in Bitcoin over the last week returned Bitcoin to a near 1 price ratio (the high from the last cycle).

The cycle behavior remains in play.

October 12, 2024

The price ratio in this cycle is now roughly equal to the prior cycle at the same time

(see the plot atop this page).

A big difference is that, in the prior cycle, the price was climbing very quick at this time.

For example, in the prior 70 days the price had almost doubled.

Bitcoin has been mostly in a downtrend for 200 days now, but has shown signs of

life more recently.

Enthusiasts say October has historically been a good month for Bitcoin,

even referring to the month as "Uptober" and predicting prices well above $70k this month.

While I don't put much faith in these predictions, we would expect increasing prices

based on the 4-year cycle behavior.

In the prior cycle the price doubled in the next 100 days, and in the cycle before that it increased

over 40%. Let's see what happens this time!

October 19, 2024

Bitcoin got a boost this week, just as the price ratio was about to fall below the prior cycle.

While that might delay it, it's highly likely this cycle's ratio will fall below the prior cycle soon.

To not do that, the price would need to increase to about $140k in the next 60 days,

something that seems well out of reach at this point.

To be clear, I'm not saying the cycle behavior is finished.

These cycles are never identical, they only have similar trends.

If we base off the cycle before last, we'd expect the $100k+ prices mid to late 2025.

November 9, 2024

Bitcoin jumped to a new high synchronous with Trump winning the election.

Is Trump really pro Bitcoin?

He spoke this way in the months leading up to the election, but

most presidential candidates (both democrat and republican), make promises

solely to gain votes.

These promises frequently go unfulfilled.

A better way to determine if a candidate will follow through is to look at

past actions, not rhetoric.

In Trump's first term he spoke negatively of Bitcoin, primarily how it was used to

fund illegal activity.

His administration took regulatory actions against crypto, including the

controversial lawsuit against Ripple.

I'm not saying the Trump administration will be anti Bitcoin,

in fact his low-regulatory approach could easily boost Bitcoin.

I'll just be surprised if he pushes hard for pro Bitcoin-specific legislation.

November 17, 2024

For the last few weeks, the price ratio has almost exactly overlapped the prior cycle

(see the plot atop this page)!

This has been welcome news for holders, providing a 34% gain in the last month.

It still seems unlikely that the price ratio will keep pace with the prior cycle,

but then again a few weeks ago I wouldn't have guessed we'd keep pace this far.

We once again witness that, when Bitcoin increases, it can increase very fast.

Trying to trade in and out and time these things is dangerous if you want to grab these gains.

November 30, 2024

The price ratio has now clearly broken below the prior cycle as

strong resistance appeared around $100k per Bitcoin (near 1.5 price ratio).

Resistance around $100k was expected—these nice, round numbers

typically bring out the sellers. Some of this is old holders that promised

to sell some Bitcoin if it ever reached $100k.

Many made promises not just to themselves, but also to spouses/family/friends and

want/need to stay consistent with what they've said.

It then becomes a self-fulfilling

prophecy when traders expect this behavior and try to sell before these people (before $100k).

It often becomes a race to sell before others—before a downturn.

After falling to $90k, Bitcoin has flirted with $98k in recent days but again

failed to reach the $100k threshold. If prior cycles are any indication, the current

stall is just a bump in the road to prices well above $100k within the next few months.

December 14, 2024

After flirting with $100k for a couple weeks Bitcoin broke through to $103k

on December 4. That was short lived—the price quickly fell back below $98k

on December 5th. It's remained in the $94k to $103k range for the last few weeks.

The sustained selling pressure around $102k to $103k surprised me.

It seemed optimism had overtaken the majority and bulls were taking over once we

shook off the more expected resistance just below $100k.

This is another example of how hard it can be to time markets.

January 13, 2025

Bitcoin's price ratio is about midway between the last cycle

and the cycle before that.

Nothing too surprising has occurred recently, just the normal

Bitcoin volatility rocking the price back and forth between

$92k and $102k.

The next big catalyst bulls are looking for is quick action from

Trump shortly after his inauguration.

If he pushes through a quick executive order, a price spike

will likely follow.

It's less clear if this will happen given other priorities.

Even if it does happen, the longer term effects are not obvious.

February 11, 2025

On January 23 Trump signed an executive order

"Strengthening

American Leadership in Digital Financial Technology."

It apparently wasn't the spark some Bitcoiners had hoped for.

Bitcoin has dropped about $7k since then.

The executive order calls for a review of crypto regulation, evaluation of

a crypto stockpile, and a ban on central bank digital currency.

The potential stockpile appears to be more about maintaining seized crypto,

not about buying crypto.

In the long run, this executive order will likely be more helpful for altcoins.

It's been less than clear which altcoins are illegal and which are legitimate, or

even how to make that call.

It seems there will not be more focus, from the highest levels, on clarifying

the rulebook for crypto.

Login to leave a comment.

Related Articles

Bitcoin price nears record high

Bitcoin after the 2018 low

Click here for a list of other recent articles.

|